The need for Stringent Carbon Pricing Regulations in India

By Sahitya Gali

Carbon Pricing, in simple terms, is putting a price on every tonne of carbon emitted by the polluters, i.e., the companies and the industries, to encourage them to lower their emissions. It has been successfully implemented in many countries, including India. Many experts and authors have identified Carbon Pricing as the most effective policy to combat climate change.

The Carbon Pricing Leadership Coalition (CPLC) stated that, as of April 2019, there are 46 national and 28 subnational jurisdictions with carbon pricing implementation, and many have scheduled to implement carbon pricing. Carbon Pricing has been applauded by many because the cost goes back to the economic sectors, which are majorly responsible for contributing to the greenhouse gas emissions.

Carbon Pricing comes in different forms and ways. Any state or country can implement carbon pricing in any way it wants, considering its status and circumstances. Therefore, the flexible mechanism of carbon pricing made the implementation succeed globally. However, the lack of a robust framework of implementation and methods has its harmful effects too. It seems that Indian sectors, especially in the private sectors, need more than just putting a price on carbon.

Indian business and sectors got motivated to implement carbon pricing for their benefits and reasons. Very quickly, major companies like Mahindra & Mahindra, Infosys Limited, Ambuja, Tata Chemicals and Essar Oil, have adopted Internal Carbon Pricing (ICP) and implemented in various ways. Internal Carbon Pricing is what companies do during the business, by putting a price on carbon internally before they emit carbon to reduce emissions and save it from climate change risks. On the other hand, External Carbon Pricing is usually in the form of taxes, which are levied by the government to redeem the carbon emitted by companies and industries.

When there is a monetary value attached to every ton of carbon emitted, businesses which take the initiative to reduce their carbon footprint, try to come up with new ideas to cut down the emissions and other risks. For e.g., many companies in the Indian private sector have started with new methods to use energy efficiently by investing in renewables. Therefore, the more renewables the companies use, the lesser are the emissions and lesser are the costs of carbon for the companies. Adoption of ICP has encouraged companies to use more renewable energy. For example, the technology companies like Infosys have now started to invest in renewable power to cut their electricity needs by a percent, decreasing their emissions and, therefore, their carbon costs.

Also, climate change risks like physical risk and regulatory risk are usually challenging to identify at the initial stages. Therefore, by adopting ICP, these companies have the benefit of identifying all the climate-related risks.

In 2008, Forward Market Commission categorized carbon credit (CERs) as a ‘commodity’. Now that CERs could be transferred physically also, this enabled trading of CERs on two major platforms i.e. National Commodity and Derivative Exchange (NCDX) and Multi Commodity Exchange (MCX). Even with such flexible framework for ICP, an impressive number of companies have adopted ICP in India. However, there is an expressed need for a robust framework of regulations to guide the companies and businesses to make the widespread adoption of ICP possible.

A 2016 WRI India survey found out that as much as the companies want to adopt ICP, there have been complexities and less guidance from the current regulations. It surveyed 30 companies in India in all major sectors like cement, IT & technology, oil, textiles, gas, manufacturing firms. The study said, “60 percent of the companies are interested in pricing carbon and quarters were already doing it. But many managers said that implementing a carbon price seems complicated, and there is little guidance available on how to adopt such a scheme and arrive at a fair price or cap. They worried that their business would become less competitive in a challenging marketplace. They also expressed uncertainty about national climate policies and the alignment of a carbon price with those policies.”

The insufficiency of policy and regulatory frameworks has failed to encourage companies and kept the potential companies in doubt in terms of investment certainty. For example, the lack of a robust emission trading system in India has dragged down all the Indian companies’ confidence over the years.

Carbon Credits are one kind of incentive to the companies which emit less carbon. These credits are like shares, which can be bought, sold, or exchanged at the market price. Under the Clean Development Mechanism (CDM) these are called Certified Emission Reductions (CERs).

Initially, India was very confident that it would be the primary seller of Carbon Credits, while Europe would be the buyer. Indian companies then, in large number, acquired the technology and took up new steps to meet the norms of the United Nations Framework Convention on Climate Change (UNFCCC). India managed to gain the right to sell carbon credits according to the criteria of UNFCCC. In 2002, the statement of Jindal Vijaynagar Steel which said that it would earn $225 million worth of carbon credits for the next ten years, started carbon trading in India. Carbon Credits even made it to the headlines of the top-selling newspaper, Times of India, on November 14, 2002, titled ‘Chill in Europe may heat India’s Carbon Credit Market’. The whole article was about how Europe would overstep the emissions target during winters and buy carbon credits from developing countries, like India. The market price of each carbon credit that year was 12-17 Euros. The Indian experts expected gains of Rs. 45000 crores then.

However, eventually, the market fell, and crores of carbon credits remain unsold today. This kind of price uncertainty keeps out many companies and industries from adopting carbon pricing.

A Global consulting firm PricewaterhouseCoopers (PwC), in one of its report ‘Shades of Green: Reflections on COP25’ suggests that “India could consider developing a robust domestic emission trading system where the private sector could participate and sell retroactive, current and future credits. For the retroactive credits, a suitable cut-off may be decided upon review of the vintage of the available credits in the market vis-à-vis the NDC commitment period. However, going by past experience, market regulations need to be stringent enough to ensure good quality credits and prevent market saturation. Quality of credits may be ensured based on the principles of additionally and sustainable development.”

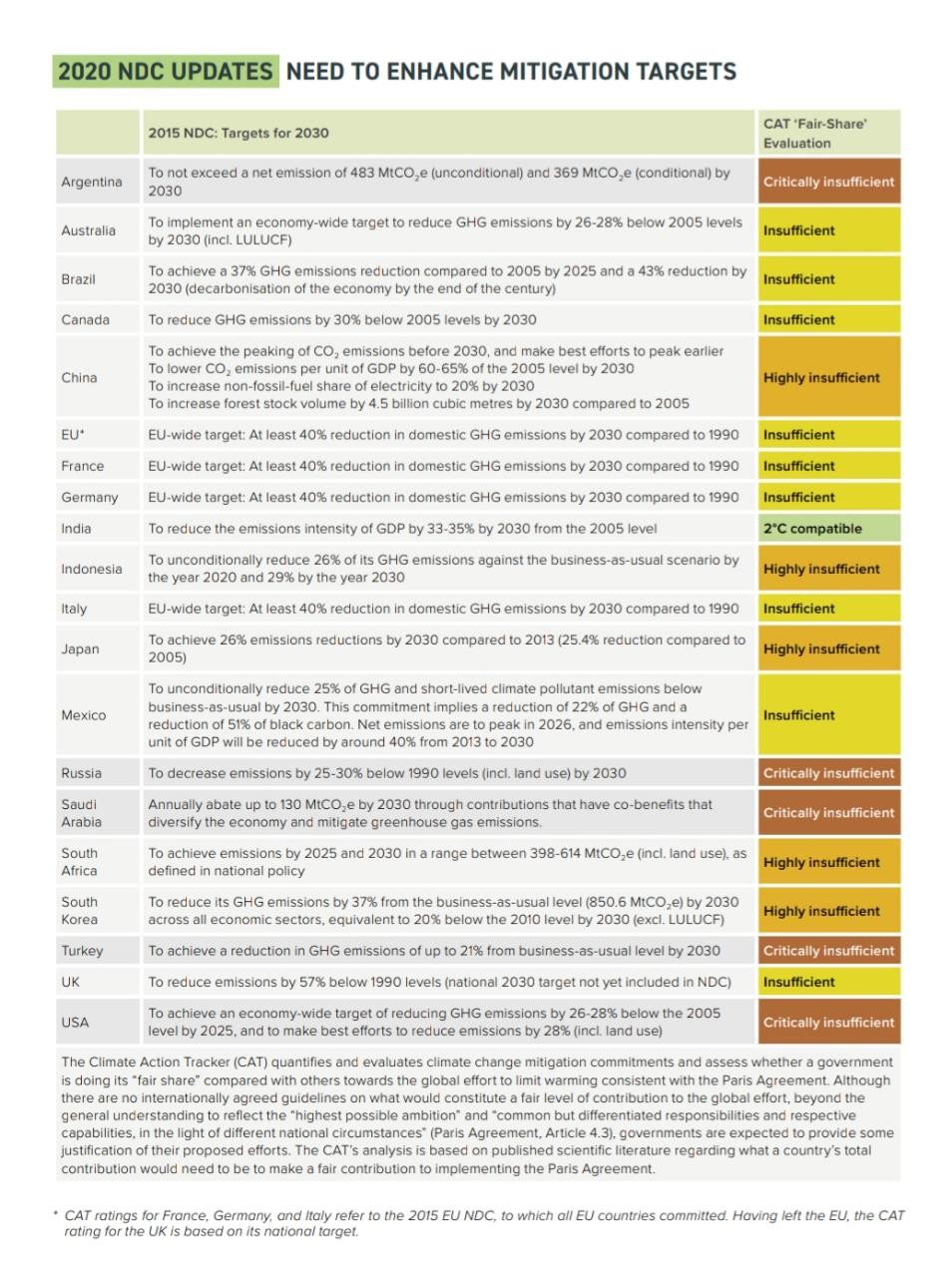

With only few companies in India which have adopted and implemented ICP successfully over the past decade, it can be said that the adoption rate of carbon pricing has been slow, unlike other countries. Unlike China, Indian government did not provide with enough awareness as to how to increase energy efficiency while managing the carbon credits. China has been successful and faster than India at achieving net zero emissions by focusing on promulgating various specific guidelines and regulations on each of its province and city. Even though the producers and manufacturers of India are ready to be a part of the Paris Agreement’s ‘2°C’ goal in the current market, India does not seem to have enough guidelines, policies, information, guidance and regulations. There are different policies, regulations, and methods through which net-zero emissions can be accomplished faster.

According to experts, carbon taxes like a tax on coal will help reduce carbon emissions faster and increase GDP by 2%. However, the coal cess seems to be ineffective because even though the coal cess penalizes every tonne of carbon from the coal, it pardons the carbon emitted from other fossil fuels. A 2018 report clearly states “Reducing subsidies to fossil fuel industries and introducing carbon pricing can increase critically needed government revenue.” Experts also believe that an explicit carbon tax will also encourage innovations in pre-existing business models like solar drones, super grids, zero energy buildings. “Carbon tax is one of the potent options to nudge the adoption of green tech and, if used wisely, can generate significant results in a short span” says Divakar Vijayasarathy, Founder and Managing Partner of DVS Advisors LLP in one of his articles titled ‘Carbon tax and its impact on India’. Secondly, India’s heavy industries have eagerly adopted carbon pricing but failed to meet net-zero emissions goals. Therefore, India needs to focus on hard-to-decarbonize sectors like iron, steel, bricks, aluminum, cement, bricks, fertilizers, etc.

However, according to the recent report, India is the only country that is likely to achieve its Paris Agreement’s ‘2°C’ goal. In this report, India is also appreciated for its carbon’s price levels and its extensive energy efficiency policies across industry. India will be on the right track to meet its net-zero goals with its upcoming plans and its aware youth, if it also considers enacting a long term strategy to achieve low carbon economy.

REFERENCES:

1. Carbon Credit Market in India: Economic and Ecological Viability by Dr. Namita Rajput1 and Ms. Parul Chopra, Global Journal of Finance and Management, ISSN 0975-6477 Volume 6, Number 9 (2014), pp. 945-950, Research India Publications.

2. Enabling Decarbonisation of Indian Industry by Will Hall published by TERI in Industry Transitions Paper on September 24, 2019.

3. Fate of Indian Carbon Credits Worth Thousands of Crores Hangs In Balance by M Ramesh published on December 06, 2019.

4. Is ‘Low Cost at All Costs’ the New Business Mantra? It Doesn’t Have to Be by Saloni Doshi for Entrepreneur on 18th October, 2018.

5. How Indian Companies are Moving Quickly on Carbon Pricing by Chirag Gajjar – March 25, 2018.

6. The Benefits of Carbon Tax by Vinod Thomas and Ed Araral published by the Hindu on September 28, 2020.

ABOUT THE AUTHOR

Sahitya Gali

If you wish to get in touch with the author of the article, you can email her at :

[email protected]

Sahitya is a graduate of Symbiosis Law School, Pune, and works as a legal associate for an IT-based firm. She hopes to contribute her knowledge as a student to law to discussions on the conservation of nature, wildlife and general environmental advocacy. When she isn’t busy working to make the world a better place, you can find Sahitya strolling through museums, or reading up some historical non-fiction, texts on Indian mythology, and anything else she can get her hands on.

Well documented thought. Congratulations Sahitya Gali.

Very good article on carbon pricing. Hope regulatory frame works will be in place in India to encourage zero carbon emissions.